Inflation and Omicron set the scene for investors

Posted by siteadmin on Tuesday 11th of January 2022

Investment Update - Inflation and Omicron set the scene for investors

Markets signed off the year amid high inflation rates and renewed concerns over the coronavirus.

The Omicron variant of the coronavirus unsettled markets at the beginning of December, with investors unsure about how renewed restrictions on socialising and travel will affect the global economy. The Organisation for Economic Cooperation and Development (OECD) urged national leaders to accelerate the vaccination rollout in order to slow the spread of the virus and reduce th...

Things to avoid when investing

Posted by siteadmin on Wednesday 10th of November 2021

Things to avoid when investing

To keep your investments from losing value or slowing the growth of your as- sets, avoid these common investing mistakes.

There are more risks and opportunities than ever for investors to navigate in today’s rapidly evolving markets. Here are four approaches we believe every investor should follow.

Don’t pile into cash – stay invested

The biggest advantage of cash is that it offers relative safety. Cash can help diversify a portfolio during times of volatility and is easy to access in an emergency. With cas...

Can your pension sustain your retirement?

Posted by siteadmin on Wednesday 13th of October 2021

Can your pension sustain your retirement?

Working out how long your pension pot will need to last – as life expectancy rises – is worth thinking about sooner than later.

The lockdown caused many people to reassess their lifestyles, which for some meant choosing early retirement. But what retirees have found is that pension pots are not matching the period of time needed to enjoy a comfortable life.

Life expectancy is going up. The Office for National Statistics offers an online calculator which gives an estimate of life expectancy – and w...

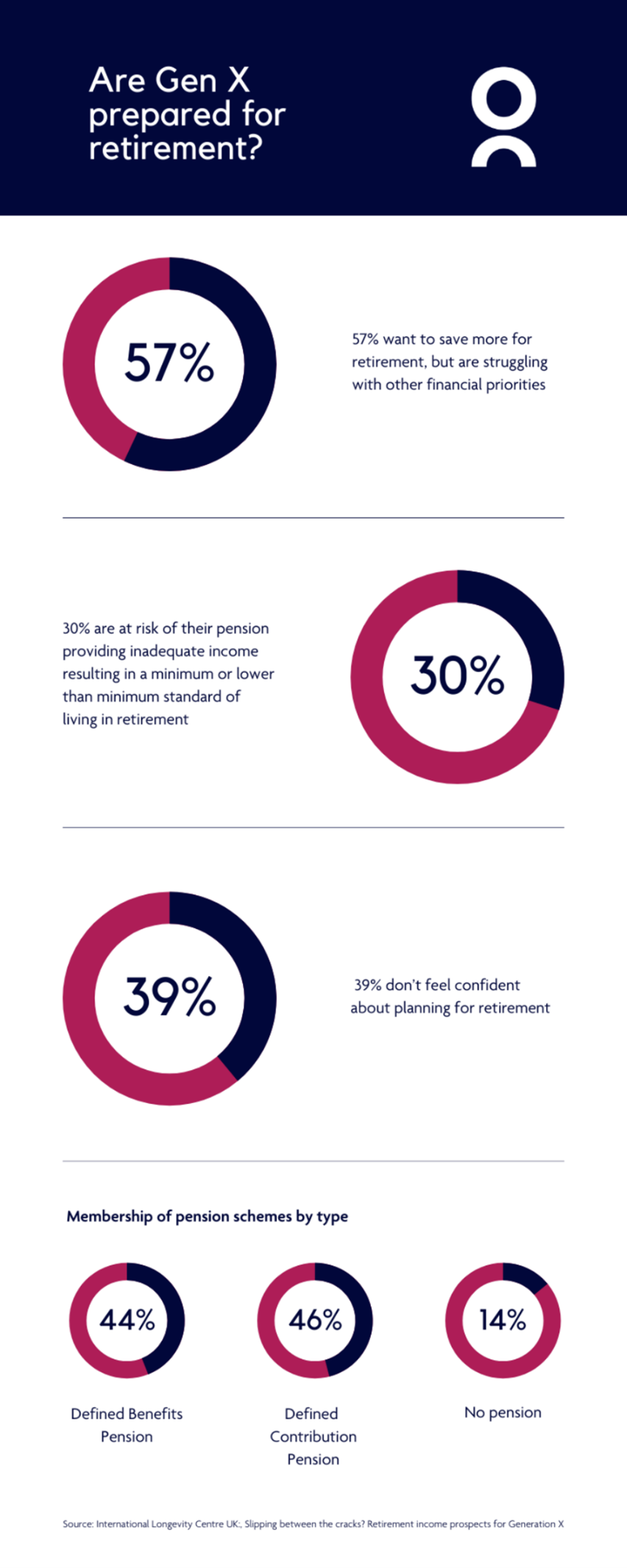

Are GenX Prepared for Retirement

Posted by siteadmin on Thursday 19th of August 2021

Dicing with the delta variant

Posted by siteadmin on Thursday 5th of August 2021

Investment Update - Dicing with the delta variant

With the UK leading the way in lifting its pandemic restrictions, the coronavirus Delta variant has put many countries on edge.

Nations experiencing a surge in the Delta variant of the coronavirus are in a race between vaccinating a majority of the public and getting ahead of the new strain in order to lift restrictions with confidence. The US, UK and EU are experiencing spikes in the rates of infections and there is some worry from economists about Europe’s previous positive outlook experi...

Time to consolidate your pensions?

Posted by siteadmin on Wednesday 28th of July 2021

Time to consolidate your pensions?

Employer pensions can accumulate as we change jobs, and it’s easy to lose track of how much each one contains. We explore what you need to know if you’re thinking about consolidating your pensions.

When you leave a job, it’s easy to forget about the workplace pension you might have had there. With the average person having several jobs during their lives, along with the 2012 introduction of auto-enrolment for employer-based pensions, it’s not surprising that many of us have more than one pension to our na...

Should we be concerned about rising inflation?

Posted by siteadmin on Friday 23rd of July 2021

Should we be concerned about rising inflation?

Most economists expect inflation to pick up over the next few months as lockdown restrictions ease and shops and restaurants reopen. But is this a cause for concern?

As lockdown measures begin to lift, financial markets are making their adjustments in anticipation of a rise in inflation, with bond yields picking up (meaning prices have fallen) and stock markets rotating from defensive sectors into cyclicals.

What is inflation?

Put simply, inflation measures the change in the prices of goods a...

Protect your possessions with accidental damage cover

Posted by siteadmin on Wednesday 21st of July 2021

Protect your possessions with accidental damage cover

Insurance claims for accidental damage increased over the past year as more people worked from home, so it’s a good time to check your own coverage.

Figures from some of the country’s biggest insurance providers have shown a sharp rise in claims of accidental damage during the lockdown.

With many millions now working from home, the chances of accidents and damage to property have inevitably gone up. Halifax Home Insurance reported a rise of 35% for claims between July and September 202...

How to plan for inheritance tax

Posted by siteadmin on Friday 16th of July 2021

How to plan for inheritance tax

Following the news that thousands more people are expected to pay the standard 40% inheritance tax this year because of the effects of the pandemic, we explore some of the ways to navigate the complexities of inheritance tax.

The complex laws around inheritance tax (IHT) caught many people off guard during the Covid-19 pandemic. Along with the often-sudden loss of a loved one came the issues arising from IHT on gifts passed down to children and grandchildren.

This tax year marks the latest in a series where...

Inflation rises, along with commodity prices

Posted by siteadmin on Monday 14th of June 2021

Inflation rises, along with commodity prices

The combined economic effects of stimulus measures, inflation and increased spending all contributed to an eventful month.

In May, vaccine rollouts gathered pace and pandemic-based restrictions began to lift in many countries. However, a new wave of cases in India raised concerns worldwide.

Despite reports that the UK economy shrank in the first quarter compared with the previous three months, the level of employment increased, although it remains below pre-pandemic levels. Inflation doubled to...