Spring Budget 2024: Winners and Losers

Posted by siteadmin on Monday 11th of March 2024

At 12.30pm on 6 March 2024, Chancellor of the Exchequer Jeremy Hunt announced the UK Spring Budget, as well as the economic and fiscal forecast by the Office of Budget Responsibility.

These legislative announcements are game-changers for Britain's economy, and Hunt’s announcements included a number of sweeping changes that could potentially affect the personal finances of everyone living and working in the United Kingdom.

In laying out the Spring Budget, Hunt reinforced the government’s dedication to building the British economy wh...

The 2023 Autumn Statement: Winners and Losers

Posted by siteadmin on Thursday 30th of November 2023

UK Chancellor Jeremy Hunt’s 2023 Autumn Statement outlined, in his words, “eight months of hard work” and no fewer than 110 measures to help grow the British economy. Contained within are a raft of measures set to overhaul everything from minimum wage and benefit payments to tax, business investment, and more.

The Winners

Young and low-paid staff

Although the news was released ahead of the main statement, the announcement confirmed a large-scale increase to the national living wage, bringing the hourly rate from £10.42 to £11.44 (an impr...

Everything you need to know about the 2023 Autumn Statement

Posted by siteadmin on Wednesday 29th of November 2023

On 22 November 2023, chancellor Jeremy Hunt delivered the Autumn Statement against a backdrop of a cost of living crisis and a looming general election.

It’s been a challenging year with inflation dominating headlines. While inflation has fallen, it’s still higher than the Bank of England’s 2% target at 4.6% in the 12 months to October 2023.

Ahead of his speech, Hunt faced pressure to reduce the tax burden on both households and businesses while there was speculation about a potential Inheritance Tax cut, which didn’t materialise.

In his ...

Autumn Statement - Key Highlights Blog

Posted by siteadmin on Tuesday 28th of November 2023

Reducing debt

- The government is reducing debt and borrowing, with borrowing forecast to be lower this year, next year, and on average over the forecast period compared to the OBR's March forecast.

- Underlying debt is also lower as a percentage of GDP, by an average of 2.1 percentage points across the forecast.

- The government is on track to meet its debt and borrowing fiscal rules with greater headroom against both rules compared to spring.

- The government has made available up to £14.1 billion for the NHS and adult social care and an add...

Home Insurance Explained

Posted by siteadmin on Thursday 27th of April 2023

One wet and windy evening, Alex and Megan decided to take advantage of their newborn, Ellie, falling asleep in her moses basket by getting an early night. Picking up the basket from its regular spot in front of the fireplace, they crept upstairs. No sooner had they settled in bed when they heard a massive crash from the living room. They ran back downstairs to find a pile of rubble in the exact spot Ellie had been sleeping just minutes earlier.

Aware the incident could have been much worse, the couple were still left with an enormous mess t...

Tips to Finding Your First Home

Posted by siteadmin on Thursday 20th of April 2023

Searching for your first home can be an overwhelming experience, but when it’s the biggest purchase of your life, you need to ensure that it’s right for you. There are so many things to consider, so to help you with one of the biggest decisions in your life, we have drawn up some helpful tips and guidance when finding your first home.

Start with an open mind

There is the danger of becoming too fixated on certain locations or certain properties. It’s important to be open when searching for your first home, ensuring that you’re considering a...

The cost of moving home

Posted by siteadmin on Thursday 13th of April 2023

Buying a home comes with extra costs and fees you need to be aware of – from securing your mortgage to booking the removal van.

Whether you’re a first-time buyer, downsizing or moving to your dream family home, it’s an exciting – and busy – time. It also comes with costs that could take you by surprise, so here’s a look at the ones you’re likely to come across and how we can help you through the journey.

Advice fee

We can help when you’re applying for your mortgage in principle, putting you in a strong position once an offer is accepte...

First-time buyers guide to saving for a house deposit

Posted by siteadmin on Thursday 6th of April 2023

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation and the cost of living increases, it can be challenging trying to save a large sum of money. It’s also important to consider all the other costs that are involved in buying a property – conveyancing, legal fees, insurance policies and moving to name a few.

How much do I need to save?

A 5% deposit of the property value is the minimum amount you are able put down, however your options may be limited. The larger deposit you can p...

Five practical ways to protect your money during the cost of living crisis

Posted by siteadmin on Thursday 30th of March 2023

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021.

While the Covid pandemic began the inflationary increase, this was further exacerbated by the war in Ukraine pushing up energy and food prices even further.

Following such an extended period of price rises, you may be concerned about your household finances and long-term plans. So, here are five ways to protect your finances during the cost of liv...

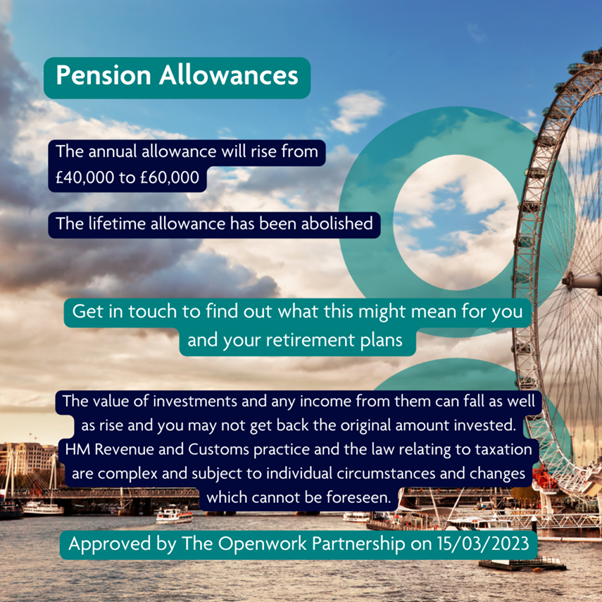

Spring Budget: Pension Allowances

Posted by siteadmin on Thursday 23rd of March 2023

Spring Budget: Pension Allowances